Your expertise drives, our thoughtful AI accelerates

Why Qognitive? Navigate AI Challenges with Specialised Solutions & Expert Support

-

update Rapidly evolving AI models require continuous evaluation and strategic selection

-

settings Lack of bespoke AI solutions hinders competitive advantage in specific domains

-

integration_instructions Integrating AI into legacy systems demands significant time and resource investment

-

block Siloed AI implementations fail to leverage cross-departmental synergies

-

compare Balancing AI automation with human expertise requires careful orchestration

The Qognitive Suite: Automate, Secure and Learn with AI

smart_toy Qognitive Team

Streamline Workflows with AI

Enhance productivity with AI agents, document processing and project intelligence to streamline collaborative workflows.

- Bespoke AI Agents

- Document Intelligence

- Project Intelligence

security Qognitive Edge

Secure AI with Private Control

Deploy fine-tuned AI models within your secure, air-gapped environment for absolute data privacy and control.

- Absolute Data Privacy

- Domain-Specific Accuracy

- Predictable Performance

school Qognitive Bloom

Deliver Adaptive Learning with AI

Transform proprietary knowledge into adaptive, personalised learning experiences powered by generative AI.

- Personalised Learning Paths

- Intelligent Course Development

- AI-Powered Coaching

Who Benefits from the Qognitive Suite? Tailored AI for Diverse Industries & Functions

-

school Knowledge-Intensive sectors such as professional services, healthcare, education and research

-

analytics Data-Driven enterprises in finance, e-commerce, manufacturing and utilities

-

lightbulb Innovation hubs including R&D departments, tech startups and creative industries

-

groups Human Capital leaders transforming HR, learning and development and talent management

-

settings_suggest Process-Intensive operations in BPO, logistics, government and customer service

Design Your AI Strategy with Domain Experts

Every organisation's AI journey is unique. Our specialists help you navigate from proof-of-concept to enterprise transformation.

Book your strategy sessionQognitive Team: Intelligent Workflows & Collaboration

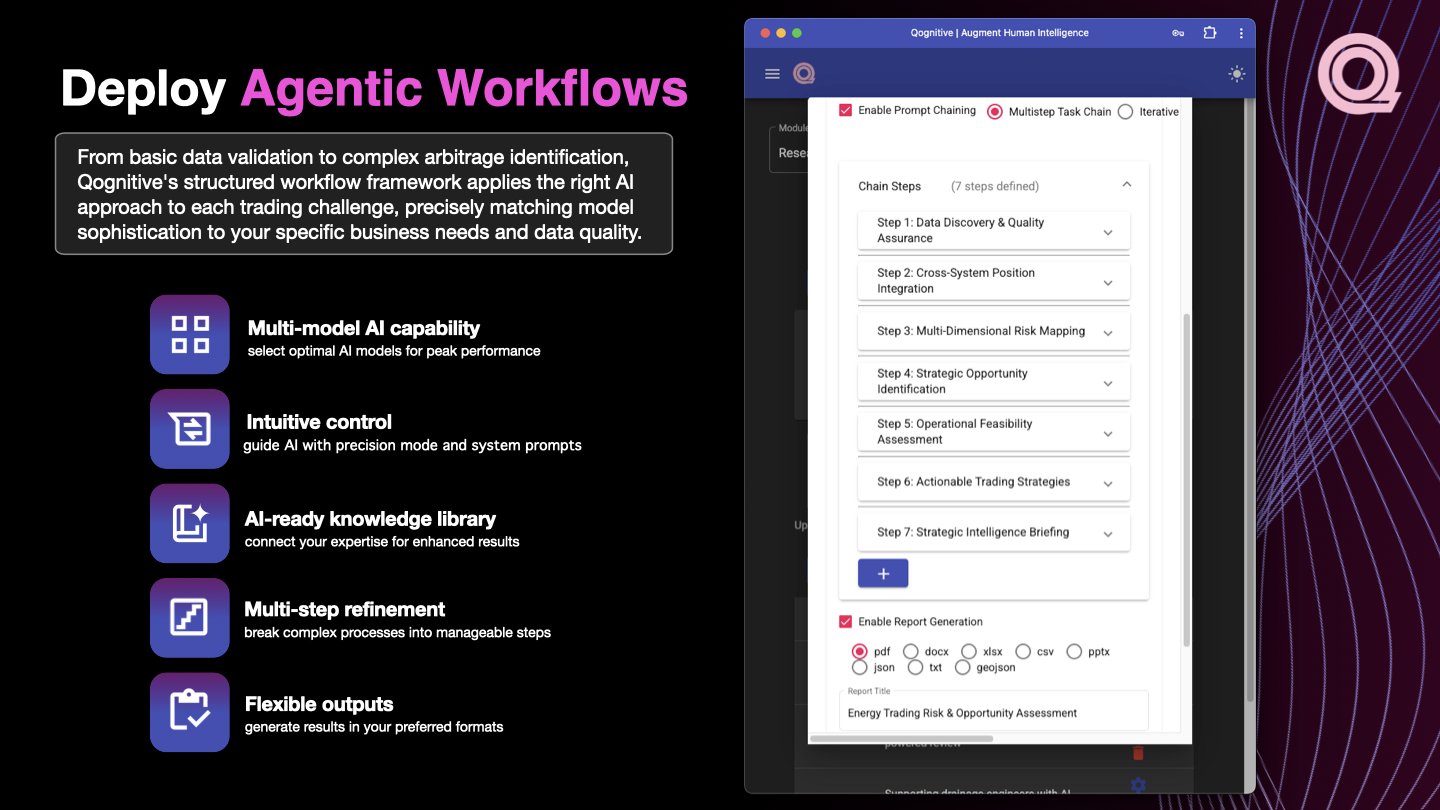

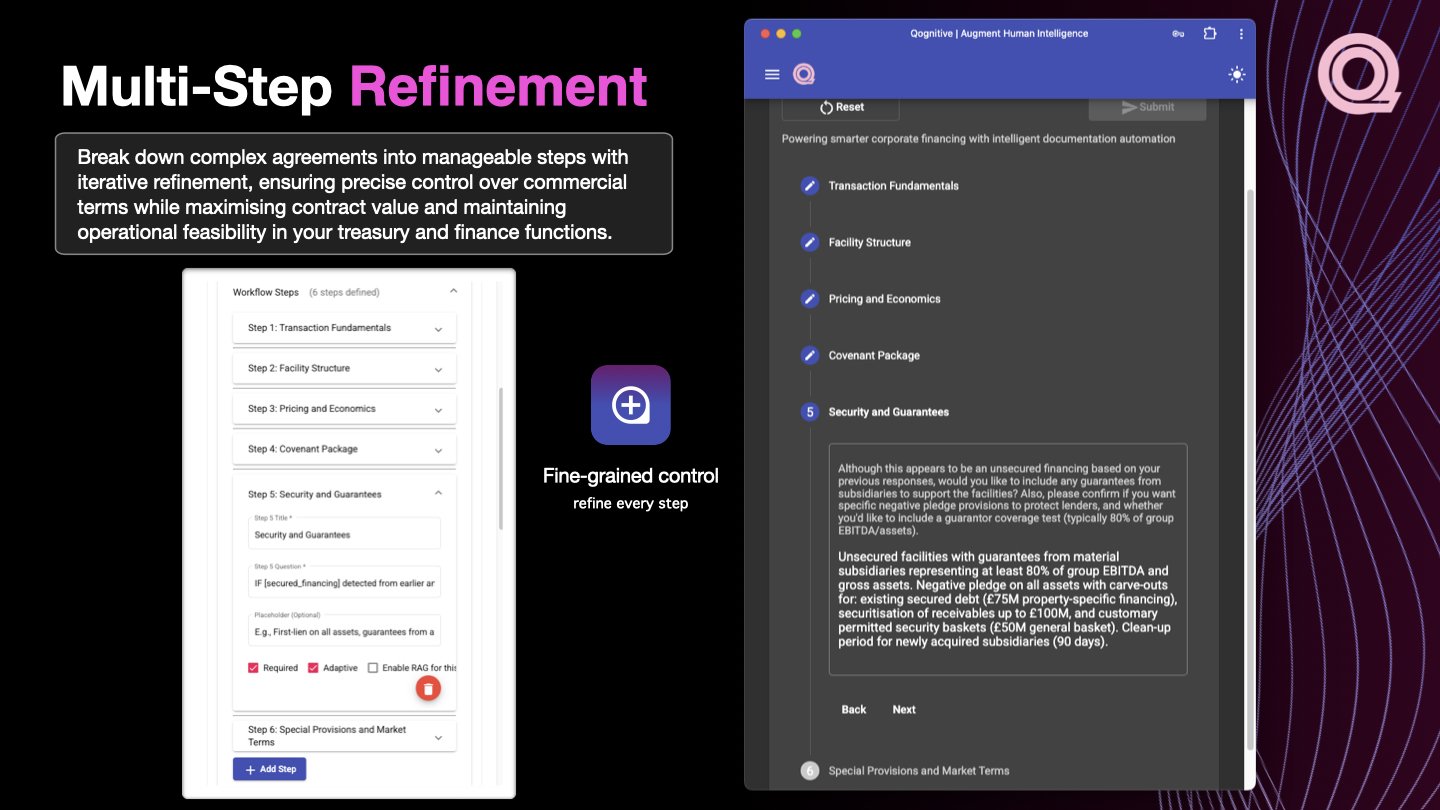

Our platform combines all essential elements for bespoke solution management: versatile model library, advanced prompt engineering (multi-step chains, recursive refinement), Retrieval Augmented Generation (RAG) for proprietary knowledge integration and vector search capabilities. As AI technology advances, Qognitive remains at the forefront, continuously incorporating new functionalities to ensure your agents evolve with your requirements.

Absolutely. A prime example is its application as an e-Discovery platform – rapidly processing vast document volumes, extracting key insights automatically, linking related information across multiple documents and dramatically reducing review time. This capability applies across industries to streamline data management, improve compliance and unlock valuable insights.

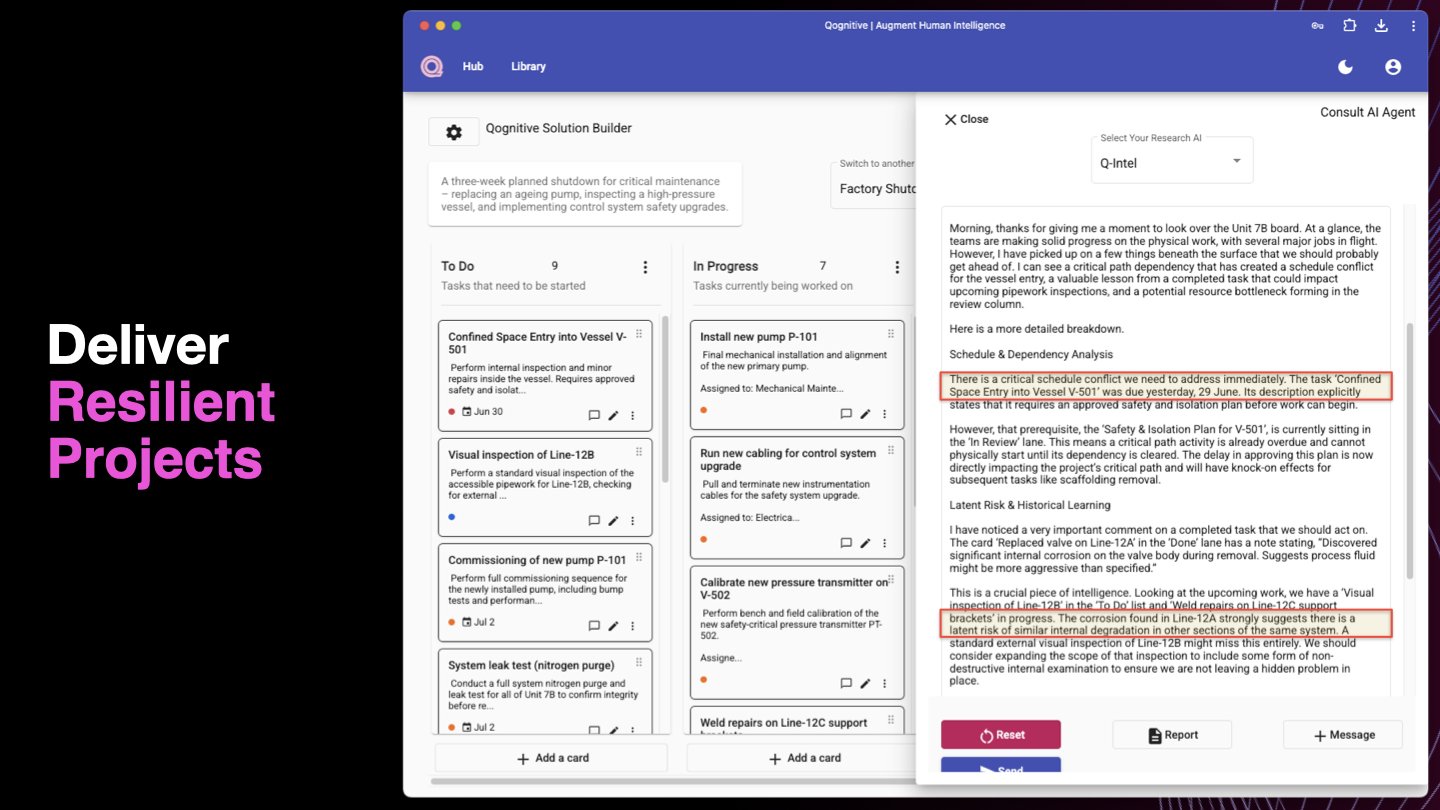

Our AI-powered Kanban-style project board goes beyond traditional tools with intelligent risk prediction, automated task prioritisation, real-time progress tracking and smart resource allocation. You can build complex AI assistants on top of the project board that provide insights, suggest optimisations, and automate management tasks – identifying potential risks before they become issues.

Team's Multi-model Capability integrates frontier models from Anthropic, Mistral AI, OpenAI and Google Vertex AI, allowing you to select the most suitable option for each specific use case. This flexibility enables powerful large-scale models for complex tasks while using smaller, efficient models for simpler operations—optimising performance, accuracy and resource usage across diverse applications.

Qognitive Edge: Private, Specialised AI

Air-gapped means Qognitive Edge operates entirely within your local environment, completely isolated from public internet access. Your sensitive data used for fine-tuning and inference never leaves your perimeter – never touches public cloud servers or third-party services. This delivers the highest level of data privacy and security.

We fine-tune open-source Small Language Models (SLMs) directly on your proprietary data within your secure environment using efficient techniques like LoRA. This trains the model to deeply understand your specific terminology, context and operational nuances, producing significantly more accurate outputs tailored to your domain.

Absolutely. Edge was specifically designed for defence, finance and healthcare environments. Its air-gapped nature simplifies adherence to strict regulations like GDPR and HIPAA. By ensuring sensitive information never leaves your organisational perimeter, Edge provides the predictable security critical for classified documentation and sensitive data.

Unlike cloud-based solutions with variable pricing, Edge operates entirely on your infrastructure with predictable, fixed costs. You avoid per-query charges and benefit from near-instantaneous responses without internet latency. This provides complete cost control and consistent performance, crucial for mission-critical applications requiring reliable AI availability.

Qognitive Bloom: Adaptive Learning & Development

Bloom analyses learner progress at granular levels (course, outcome, concept), identifies knowledge gaps, then dynamically adjusts content and pathways. Combined with AI-powered feedback and flexible scoring that understands individual learning patterns, this creates unique learning journeys tailored to each person's pace and style.

Our system empowers L&D professionals with AI-driven workflows for developing learning materials and corporate training. This includes AI-assisted generation of learning outcomes, lesson plans, problem sets and project ideas – significantly reducing development time while ensuring content remains fresh and relevant.

Yes. By leveraging AI-powered adaptive assessments and micro-lessons, Bloom tailors experiences to individual pace, style and preferences while simultaneously aligning with broader organisational objectives. This dual focus leads to improved skills development, employee satisfaction and better achievement of organisational goals.

This advanced approach uses vector representations of learning materials to capture deep semantic relationships within subject matter. It enables highly personalised learning pathways, recommending the most relevant content based on current knowledge and goals, reducing time on redundant material and increasing return on training investments.

Choose Your Path: Deployment Options for Team and Bloom

group Flow

Hosted AI Solutions with Expert Support

- Your exclusive group at flow.qognitive.app

- AI experts to onboard and support your team

- Ideal for smaller teams and specific use cases

diversity_2 Accelerate

Balance of Customisation and Rapid deployment

- AI hub at your-organisation.qognitive.app

- Tailored solutions to accelerate AI adoption

- Perfect for organisations ready to scale

corporate_fare Scale

Enterprise-Grade AI Transformation

- Full-scale deployment within your cloud

- Designed for enterprises with multifaceted needs

- Maximum control, security and scalability

Experience the Qognitive Suite: Real-World Impact Stories

A multinational corporation's finance team was drowning in manual processes across treasury management, regulatory reporting and complex contract analysis. Legacy systems created data silos between departments, whilst volatile market conditions demanded faster decision-making than traditional workflows could support. Manual cash forecasting, covenant compliance monitoring and financial document review were consuming valuable resources that could drive strategic growth initiatives.

Qognitive Team's AI-powered suite transformed their operations through intelligent document processing that seamlessly ingested data across SAP, Oracle and banking platforms, eliminating manual consolidation whilst revealing valuable insights hidden within their finance infrastructure. Custom AI agents were configured for specific treasury functions – from cash flow forecasting to liquidity risk assessment – with multi-step workflows that automatically validated data, analysed historical patterns and generated 13-week rolling forecasts with scenario planning capabilities.

The finance team experienced dramatic improvements in operational efficiency through automated contract analysis that instantly identified critical terms, covenants and compliance requirements across their debt portfolios. AI-powered cash management optimised positioning strategies whilst flagging potential shortfalls or excess liquidity opportunities. Complex structured finance documentation – previously requiring weeks of manual review – was now processed in hours, with intelligent validation engines ensuring accuracy across all agreements whilst maintaining regulatory compliance.

Strategic decision-making accelerated through real-time treasury dashboards that provided actionable insights for capital optimisation and risk management. The system's ability to process multi-currency data, analyse FX impacts and assess debt covenant implications enabled proactive financial planning that enhanced competitive positioning. Finance leaders gained the decisive advantage of predictive analytics whilst ensuring operational liquidity and regulatory adherence – transforming reactive processes into intelligent, forward-looking financial operations that drive measurable business value.

A leading energy trading firm was grappling with the complexity of managing multi-commodity portfolios across fragmented systems like OpenLink and Murex, whilst navigating compressed margins and accelerating market volatility. Legacy infrastructure created data silos between trading, risk and operations teams, slowing critical decision-making and obscuring valuable insights buried within their trading systems. Manual reconciliation processes consumed precious time that traders needed for strategic positioning and market analysis.

Qognitive Team's AI Agents revolutionised their operations by seamlessly ingesting and analysing data across standalone systems, eliminating manual reconciliation and revealing actionable intelligence hidden within their trading infrastructure. The bespoke EnergyTradeIQ agent transformed fragmented data into coherent market insights, whilst sophisticated agentic workflows applied precisely the right AI approach to each challenge – from basic data validation to complex arbitrage identification – matching model sophistication to specific business needs and data quality.

The firm's proprietary trading documentation and contract precedents were transformed into AI-ready knowledge libraries, enabling sophisticated analysis that respected their unique market expertise whilst capturing institutional knowledge across complex parameters. Multi-step refinement workflows broke down intricate LNG agreements into manageable components, ensuring precise control over commercial terms whilst maximising contract value and maintaining operational feasibility. The system's iterative approach to contract analysis delivered granular control over pricing structures, delivery terms and risk provisions.

Enhanced operational efficiency emerged through automated cross-system position integration and multi-dimensional risk mapping, freeing traders to focus on strategic opportunity identification rather than data reconciliation. The AI-powered risk assessment capabilities provided real-time analysis of physical positions and derivatives, considering counterparty limits and regulatory compliance whilst identifying potential losses exceeding risk appetite. Strategic intelligence briefings now deliver actionable insights prioritised for trading professionals, whilst automated quality assurance and firm-wide knowledge accessibility have transformed how the organisation captures and leverages its collective expertise across increasingly competitive energy transition markets.

A major industrial facility was struggling with the mounting complexity of health, safety and environmental compliance across their operations. Traditional reactive approaches to incident management, regulatory audits and environmental reporting were consuming valuable resources whilst leaving critical blind spots in their risk management framework. Manual consolidation of data from multiple systems – CMMS logs, safety committee minutes, incident reports and regulatory guidance – was time-intensive and prone to oversight, making it difficult to identify emerging patterns or systemic weaknesses before they escalated into serious incidents.

Qognitive Team's HSE Intelligence solution transformed their approach by seamlessly ingesting and analysing data from regulatory frameworks, safety cases and operational systems. The AI-powered platform eliminated manual consolidation whilst revealing critical risks and hidden insights that traditional methods missed. Bespoke AI agents, configured with deep expertise in UK COMAH regulations and high-hazard chemical site requirements, could rapidly cross-reference evidence across complex documentation, identify non-conformances and prioritise systemic weaknesses by risk severity. Multi-step workflow chains broke down complex processes – from incident investigations to comprehensive audit preparation – into manageable, iterative steps with fine-grained control over each phase.

The transformation was remarkable. What once took weeks of manual investigation and analysis now happened in hours, with AI-driven root cause analysis identifying patterns across historical incidents that human reviewers had missed. The system's ability to create AI-ready knowledge libraries from incident reports, job safety analyses and maintenance histories enabled sophisticated predictive insights that turned historical data into preventative intelligence. During a recent audit preparation, the platform automatically generated comprehensive evidence packages, identified compliance gaps and provided risk-based corrective action recommendations – transforming scattered documentation into audit confidence whilst ensuring nothing critical was overlooked.

The facility now operates with true predictive resilience rather than reactive crisis management. Real-time risk sensing replaces historical reporting, intelligent assurance systems replace manual checks and unified institutional knowledge replaces siloed data. Most importantly, their safety teams can focus on what truly matters – protecting their people and environment—whilst the AI handles the complex analysis and documentation that underpins world-class HSE performance. The result is enhanced worker well-being, robust compliance assurance, and the proactive risk management that defines the most respected and resilient organisations in high-stakes industries.

A leading risk advisory firm was engaged by a Tier 1 investment bank to conduct comprehensive regulatory compliance assessment across European trading operations. The bank faced mounting regulatory pressure following market volatility, with particular scrutiny on MiFID II transaction reporting, best execution policies and systematic internaliser obligations. The challenge was compounded by strict data governance – no client data or proprietary information could leave their secure perimeter under any circumstances, whilst the advisory firm needed sophisticated analytical capabilities within tight regulatory deadlines.

Qognitive Edge transformed the engagement by deploying a fully air-gapped AI system within the bank's secure environment. The platform was fine-tuned on financial regulatory frameworks, MiFID II requirements and the bank's specific trading terminology, enabling sophisticated analysis without external data exposure. Custom AI models trained on regulatory guidance, compliance precedents and historical submissions created domain-specific intelligence that understood systematic internalisation rules, best execution obligations and transaction reporting requirements.

The Edge deployment revolutionised compliance review through intelligent pattern recognition that automatically flagged potential regulatory breaches across vast trading datasets. AI-powered analysis identified systematic weaknesses in best execution processes, inconsistencies in client categorisation and gaps in transaction reporting that manual reviews had missed. Complex regulatory calculations were automated with precision exceeding manual capabilities whilst ensuring complete audit trails for regulatory scrutiny.

The transformation delivered accelerated regulatory readiness and enhanced compliance confidence. What would have taken months of manual analysis was completed in weeks, with AI-powered insights revealing compliance risks that traditional approaches would have overlooked. The bank gained comprehensive visibility into regulatory exposure whilst maintaining absolute data sovereignty, enabling them to address compliance gaps before regulatory intervention whilst demonstrating that advanced analytical capabilities and uncompromising data security work seamlessly together.

A top-tier City law firm was grappling with mounting pressure to reduce training costs whilst maintaining exacting standards that justified premium rates. Traditional pupillage required intensive partner supervision, with senior lawyers spending up to 30% of billable time mentoring junior staff through complex commercial transactions. Meanwhile, clients expected junior associates to demonstrate sophisticated legal reasoning early in their careers, whilst experienced partners approaching retirement risked taking decades of specialised knowledge in structured finance, regulatory compliance and cross-border M&A with them.

Qognitive Bloom transformed their approach by capturing senior partner expertise across key practice areas and converting it into intelligent, interactive training modules. The platform worked with partners to document decision-making processes for complex legal scenarios – from due diligence red flags in private equity transactions to regulatory strategy in financial services matters. Rather than generic legal education, the system created firm-specific learning pathways reflecting actual client work, precedent documents and strategic approaches.

The implementation delivered measurable improvements in training efficiency and quality outcomes. Associates reached competency in complex practice areas 40% faster, with standardised assessments showing improved performance in legal reasoning, client communication and commercial awareness. Partner time spent on routine training supervision decreased by 50%, allowing senior lawyers to focus on business development and complex client matters. Graduate recruitment became more competitive, with candidates attracted by innovative training approaches.

The transformation enabled the firm to maintain market position whilst adapting to changing client expectations. Associates now combine traditional legal skills with AI proficiency, delivering faster, more thorough analysis whilst maintaining judgement and commercial insight that distinguishes top-tier legal advice. The firm's training programme became a recruitment advantage, demonstrating how thoughtful integration of technology with human expertise creates more capable lawyers and sustainable business models.

Join Leaders Already Transforming with Qognitive

From treasury automation to predictive safety – see what's possible when thoughtful AI meets human expertise.

Explore partnership options